France was on the verge of national bankruptcy when the Revolution began in 1789. A rising chorus of panicked legislators called for printing paper money as a solution, but many people still remembered the ruin their ancestors suffered only 70 years before.

Read MoreDusting Off an Old but Important Story

Dusting Off an Old but Important Story

By Lawrence W. Reed

In his March 1914 Introduction to Andrew Dickson White’s classic essay, Fiat Money Inflation in France, John Mackay offered this ironclad wisdom every lawmaker should memorize:

Legislatures are as powerless to abrogate moral and economic laws as they are to abrogate physical laws. They cannot convert wrong into right nor divorce effect from cause, either by parliamentary majorities, or by …public opinion. The penalties of legislative folly will always be exacted by inexorable time.

But of course, eternal truths rarely stop public officials from pursuing folly, especially if it pays in the short term by facilitating re-election.

The focus of Mackay’s comment, and of White’s essay, was one of the greatest economic follies of the late 18th Century: the paper-money hyperinflation during the worst years of the horrific French Revolution. White was a Cornell University history professor and U.S. ambassador to Russia and Germany. Thanks to his research, we can learn more in one evening about a major country’s experience with runaway prices than most of today’s congressmen will likely learn in a lifetime.

France was on the verge of national bankruptcy when the Revolution began in 1789. A rising chorus of panicked legislators called for printing paper money as a solution, but many people still remembered the ruin their ancestors suffered when unbacked paper produced hyperinflation barely 70 years earlier.

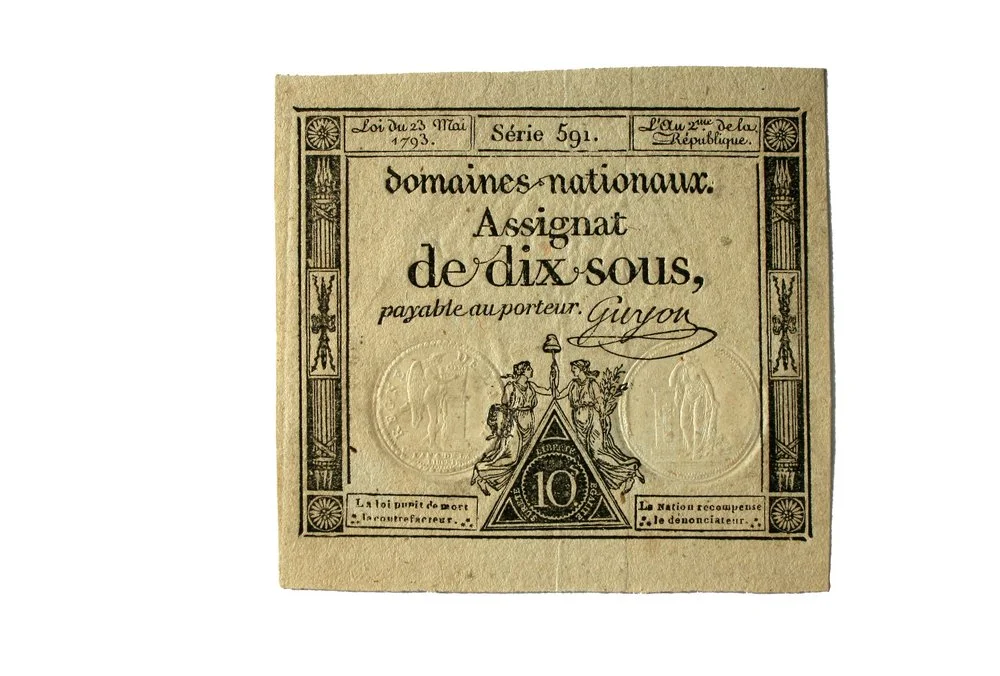

When the revolutionaries began printing paper assignats in April 1790, they thought they had solved the problem. They would “back” the new currency with the lands and property seized from the Catholic Church! Of course, this was a subterfuge of minimal effect. You couldn’t “redeem” your paper assignats for anything but what they might fetch you in the marketplace. And the French government printed so many that by 1796, they were all utterly worthless.

Even the British, at war with the French, got in on the act. They counterfeited assignats and then arranged for their mass distribution all over France. In similar fashion, the Brits had sabotaged America’s continental dollars a few years before, a story I revealed in Paper Money as a Weapon of War.

When Money Goes Bad (a title of one of my free eBooks), prices skyrocket and the economy breaks down. “The process [of inflation] engages all the hidden forces of economic law on the side of destruction,” wrote 20th Century British economist John Maynard Keynes, “and does it in a manner that not one man in a million is able to diagnose.” The turmoil it creates brings with it some very dire social and psychological effects, a fact captured in this line from John Mackay’s Introduction to Andrew Dickson White’s essay: “A wholesale demoralization of society [takes] place under which thrift, integrity, humanity, and every principle of morality [is] thrown into the welter of seething chaos and cruelty.”

My purpose here is to entice readers to take a look at White’s essay. In fewer than 70 pages, you will be fascinated and appalled by the monetary debates in the French government during the 1790s. They may resonate like eerie echoes as you think about the general level of monetary knowledge in our own time. And if you find money and its destruction to be subjects about which you wish to know more, I’ve included a list of readings below from which you can learn a great deal more.

For additional information, see:

Fiat Money Inflation in France by Andrew Dickson White

Paper Money as a Weapon of War by Lawrence W. Reed

America’s First Experiment with Paper Fiat Money by Lawrence W. Reed

Where Have All the Monetary Cranks Gone? by Lawrence W. Reed

When Money Goes Bad by Lawrence W. Reed

The Abuse of Money, Part 1 by Lawrence W. Reed

The Abuse of Money, Part 2 by Lawrence W. Reed

Ruining the Money by Lawrence W. Reed

Steve Forbes Documentary on Money (video)

Is Hyperinflation Possible in the United States? by Lawrence W. Reed

Lessons on Money from Two Henrys by Lawrence W. Reed

How the U.S. Ended Civil War Inflation by Lawrence W. Reed

When Thoughts Turn to Gold by Lawrence W. Reed

#####

(Lawrence W. Reed is President Emeritus, Humphreys Family Senior Fellow, and Ron Manners Global Ambassador for Liberty at the Foundation for Economic Education in Atlanta, Georgia. He blogs at www.lawrencewreed.com.)